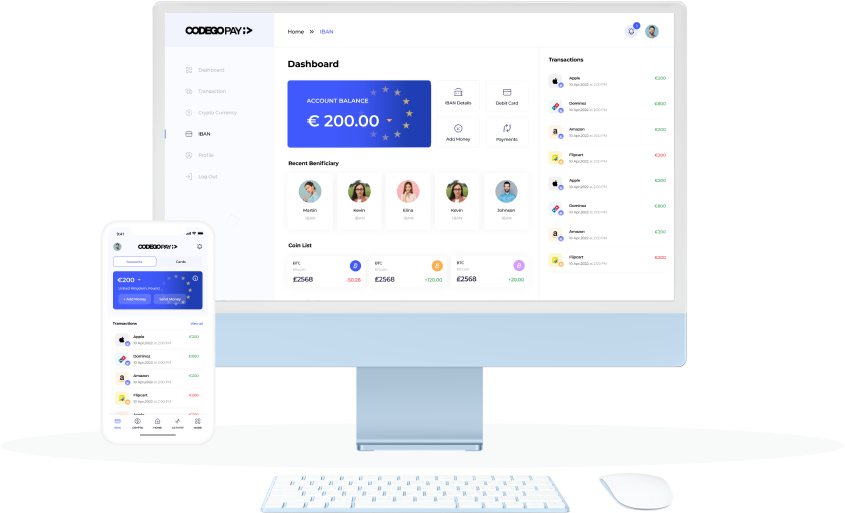

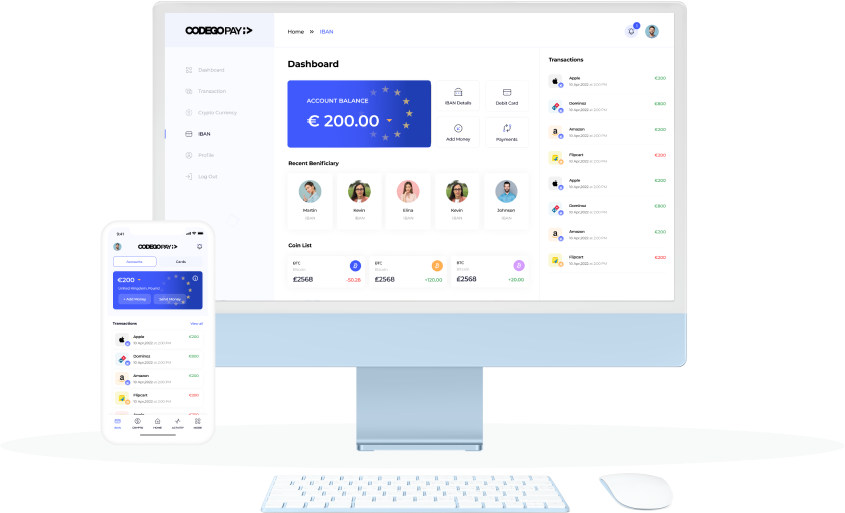

Setup your own bank

The Virtual IBAN solution

Multi-Currency Account

European Virtual IBAN's

Card Issuing Management

Swift Payments Onboard

Instant SEPA Transfer

KYB/AML Liveness tool

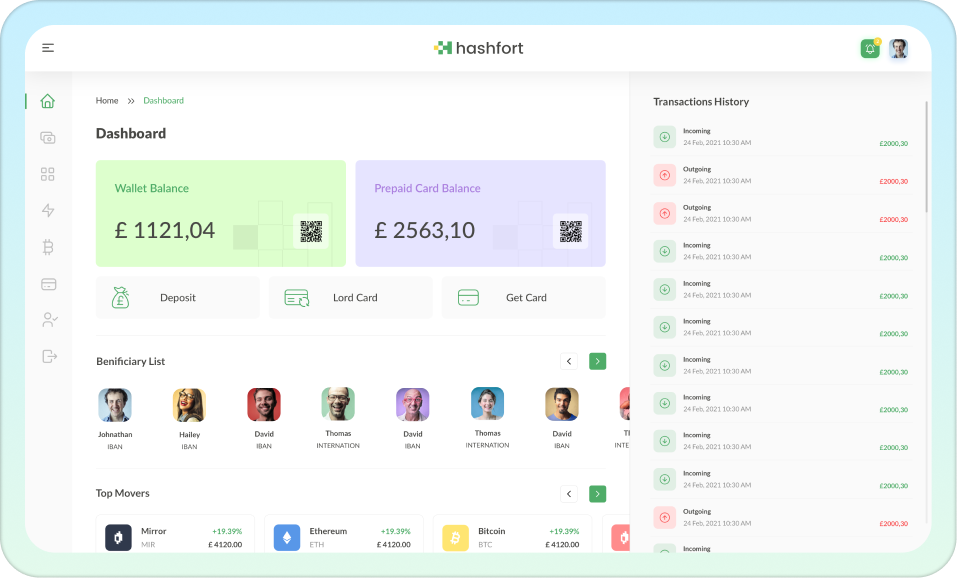

The new criteria of Core Banking

Codego Core Banking will allow you to have the essential core to be able to develop and offer financial services.

What is core banking?

Core banking is a banking service provided by a group of networked bank branches where customers may access their bank account and perform basic transactions from any of the member branch offices. Core banking is often associated with retail banking and many banks treat the retail customers as their core banking customers. Businesses are usually managed via the corporate banking division of the institution. Core banking covers basic depositing and lending of money. Core banking functions will include transaction accounts, loans, mortgages and payments. Banks make these services available across multiple channels like automated teller machines, Internet banking, mobile banking and branches.[1] Banking software and network technology allows a bank to centralise its record keeping and allow access from any location.

Wikipedia Source

Why choose Codego 🎖️

One partner and all in one

Cards activated 2022

Payment Processed 2022

White label core banking 2022