Experience hassle-free business expenses with our cards✨

Streamline your business expenses with ease - get your company's expense card today!🔥

Customizable spending limits

With business expenses cards, employers can set spending limits for individual employees or teams based on their job function, department, or project. This helps control spending and reduces the risk of fraud.

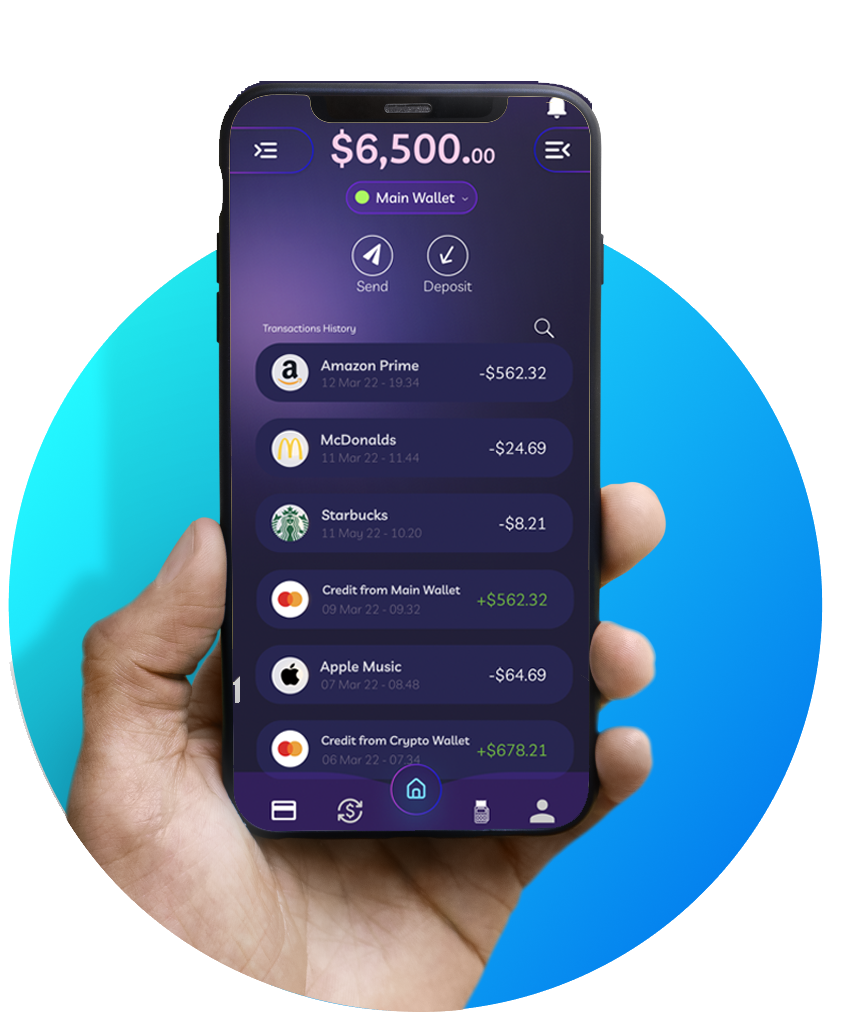

Real-time expense tracking

Many business expenses cards come with online account management tools that allow employers to track expenses in real-time. This provides visibility into employee spending and helps identify any unauthorized transactions.

Customizable spending categories

Business expenses cards often allow employers to customize spending categories, such as travel, office supplies, or entertainment. This makes it easier to track expenses by category and simplifies the accounting process.

Rewards and cash back

Many business expenses cards offer rewards or cash back on purchases. These rewards can be redeemed for travel, merchandise, or statement credits, providing businesses with additional value for their spending.

Employee spending reports

Business expenses cards typically provide detailed spending reports that can be used for accounting purposes. These reports can be customized by date range, employee, or spending category, making it easy to reconcile expenses and prepare financial statements.

Expense management tools

Some business expenses cards come with integrated expense management software that streamlines the expense reporting process. These tools allow employees to submit expenses for approval and provide employers with a centralized platform for managing expenses..

Your white label ready to go in 2 weeks 📱

Expense cards, also known as corporate or business credit cards, are payment cards designed for use by companies and their employees. These cards are a convenient and efficient way for businesses to manage their expenses, streamline their accounting processes, and improve their financial control. Expense cards work much like personal credit cards, but with additional features and benefits tailored specifically to the needs of businesses. For example, many expense cards allow employers to set spending limits for individual employees or teams, and to monitor spending in real-time through online account management tools. This can help prevent overspending, reduce the risk of fraud, and simplify the reimbursement process for employees.

Contact us

Get startedyour card design on Apple pay and Google pay

Expense cards, also known as corporate or business credit cards, are payment cards designed for use by companies and their employees. These cards are a convenient and efficient way for businesses to manage their expenses, streamline their accounting processes, and improve their financial control. Expense cards work much like personal credit cards, but with additional features and benefits tailored specifically to the needs of businesses. For example, many expense cards allow employers to set spending limits for individual employees or teams, and to monitor spending in real-time through online account management tools. This can help prevent overspending, reduce the risk of fraud, and simplify the reimbursement process for employees.

Top Integration 🤝🏻

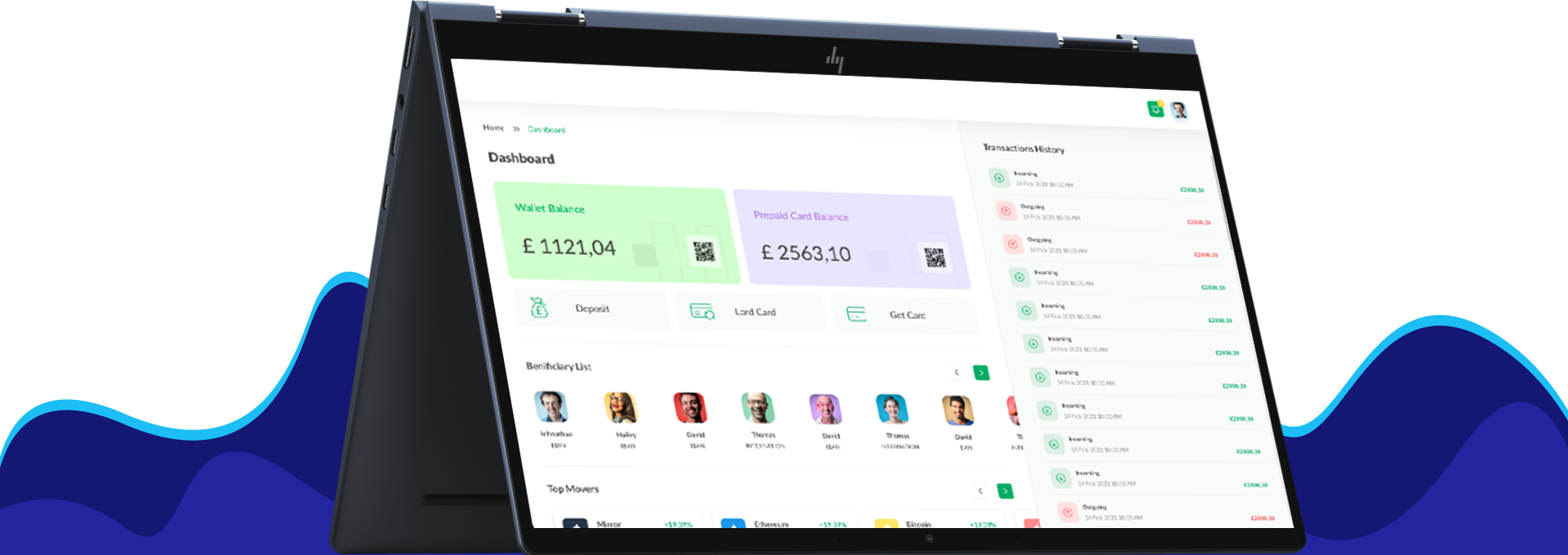

What is core banking?

Card Expense, expense details in real time, and comparisons with previous months. Our core banking helps users understand where their spending is going

Features 1

Different deposit methods. Bank transfer, voucher code and topup with a prepaid/debit or credit card in real time from any network

Features 2

Our strength is PSD2, with strong authentication. Your device, and your face become the token to authorize. Payments authorized only by the real user

Features 3

Why choose Codego 🎖️

One partner and all in one

Cards activated 2022

Payment Processed 2022

White label core banking 2022